- HOME

- SUSTAINABILITY

- Environment

- Climate-related Disclosure in Accordance with TCFD recommendations

Climate-related Disclosure in Accordance with TCFD recommendations

DMG MORI endorses its intention of proactively disclosing items with relation to climate change-related risks and opportunities in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and is taking the following measures.

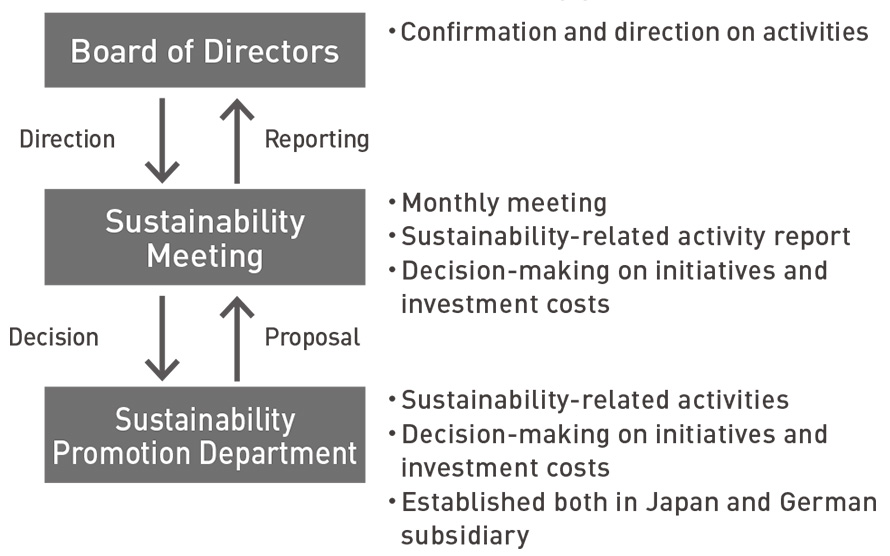

Governance

A dedicated department for planning, implementing, and monitoring climate-related measures

The Company has established the Sustainability Promotion Department as a department that assesses business risks and opportunities related to climate change, and plans, implements, and monitors the Company’s countermeasures. This department reports the results of the Company’s CO₂ emissions to the Board of Directors as necessary, and requests approval for CO₂ emissions reduction plans as well as related important capital investment plans from the Board of Directors.

Climate-related Risks and Opportunities

Strategy

Contributing to Climate Action Through Machining Transformation (MX)

The key pillars of Machining Transformation are Process Integration, Automation, and Digital Transformation (DX). Together, they increase customers’ productivity and free up management resources which in turn leads to a reduction in carbon emissions. Based on this principle, the Company believes that the advancement of MX contributes to the Green Transformation (GX) of the manufacturing industry. By enhancing its machine tool business, the Company is actively contributing to addressing the global challenge of climate change. In addition, the Company is engaging in various initiatives that include the utilization of solar power generation at its plants and the implementation of business practices according to the concept of a circular economy in pursuit of CO₂ emission reduction across Scope 1, 2, and 3.

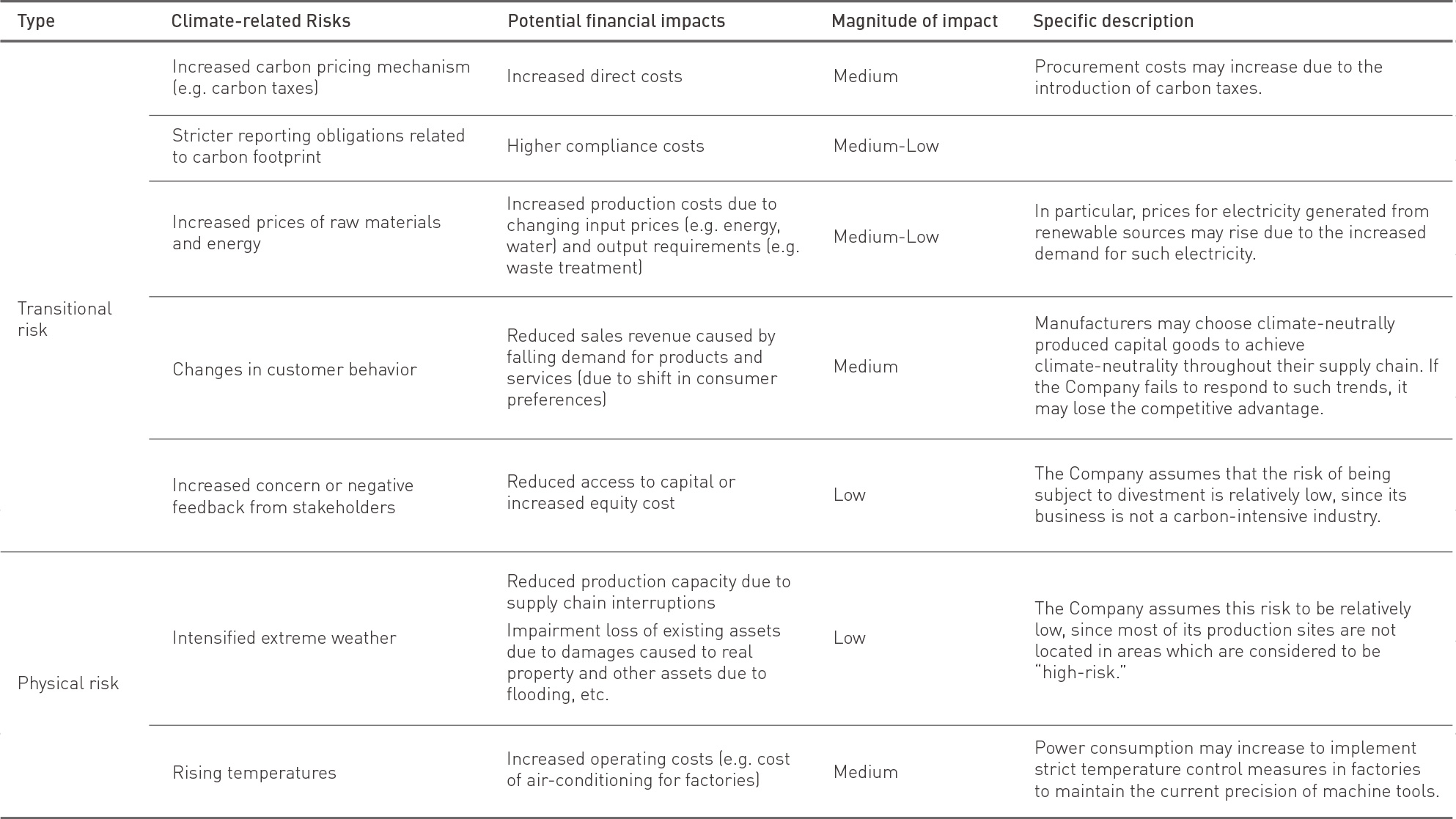

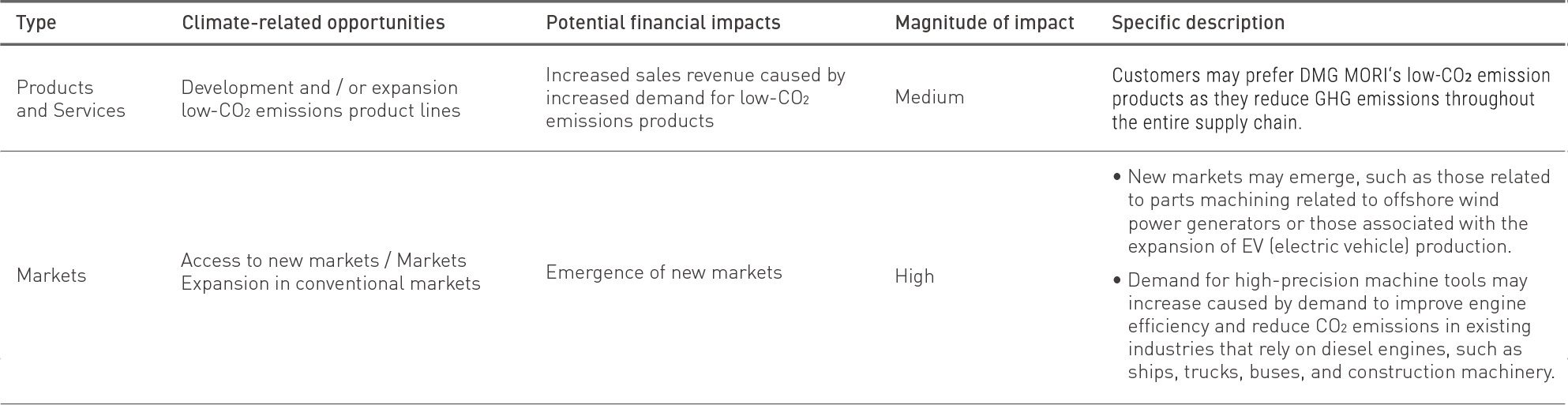

1. The business, strategic, and financial implications of climate change scenarios based on identified risks and opportunities

In identifying climate-related risks and opportunities that affect the DMG MORI Group's businesses, strategies, and finances, we have identified (1) a 1.5°C worldview in which decarbonization will progress (transition risk) and (2) a 4°C worldview in which warming will proceed as a matter of course (physical risk). The following is an assessment of the drivers of climate change and the risks and opportunities associated with our business in each of these worldviews.

Climate related risks

Climate-related opportunities

The impact is defined as "high" for events with an "impact on revenues, expenses, investments, and financing" of JPY 50 bn. or more, "medium" for events with an impact of JPY 5 bn. or more but less than JPY 50 bn., and "low" for events with an impact of less than JPY 5 bn.

2. Transition plan consistent with the 1.5°C target

Achievement of the 1.5°C target

The DMG MORI Group has acquired certification for the SBT Initiative's greenhouse gas reduction targets in order to achieve the 1.5°C target consistent with the Paris Agreement, and is working to reduce emissions throughout its supply chain. The entire Group is actively implementing various initiatives, including the introduction of renewable energy sources, such as solar power generation and CO₂-free electricity, and the use of electric furnaces for casting manufacturing. The Company’s efforts include the reduction of CO₂ emissions for its products in use at customer sites by promoting MX with process consolidation, automation, and DX at its core. The Company is actively promoting resource recycling initiatives according to the concept of a circular economy.

Risk management

Engagement as a critical management issue

At the Company, climate change-related risks are identified and assessed on a daily basis by the Sustainability Promotion Department and reported monthly to the Board of Directors. At the Board of Directors' Meeting, discussions and decisions on climate change-related proposals are made at least once every half a year, or whenever a relevant matter arises that could have a significant impact on our business.